Fact Sheet

Financial Supports For Parents

Get familiar with some information and financial supports available to parents in Ontario.

Planned Parenthood Toronto (PPT) is a pro-choice organization. When you are pregnant, we believe that you have the right to access factual, caring and non-judgmental information and services on all three of your options: abortion, adoption, and parenting. If you need support with decision making, contact PPT to book an appointment.

This factsheet has some basic information on financial supports for parents in Ontario and how to find out more.

Government Tax Credits

The Canada Child Benefit is a monthly payment to eligible families to help them with the cost of raising children under 18. It includes the Child Disability Benefit and the Ontario Child Benefit.

- The Child Disability Benefit is paid to people who care for a child under age 18 who has a disability.

- The Ontario Child Benefit is paid to help low- to moderate-income people provide for their children.

- The GST/HST credit is a payment every three months that helps people with low or modest incomes offset all or part of the GST or HST that they pay.

To get these tax credits, you need to file your taxes and keep your personal information updated with the Canada Revenue Agency (CRA). The CRA has an online calculator to help parents estimate how much money they would get from federal and provincial tax credits here: http://www.cra-arc.gc.ca/bnfts/clcltr/cfbc-eng.htmlHow do I apply?

You apply for these credits through the CRA web portal or by mailing a form to your tax services office. If your child is born in Canada, you can choose to apply for them when you register your child’s birth.

Ontario Works (OW)

Ontario Works (OW) offers assistance to people in financial need including:

- Payments to help with basics like food, clothing, and shelter.

- Prescription drug benefits through the Ontario Drug Benefit (ODB).

- Employment assistance to help find, prepare for, and keep a job.

- Additional payments including a “special diet allowance” for some health conditions, pregnancy or breast/chestfeeding.

- Emergency assistance for people in a crisis or an emergency situation (e.g. people who have lost their homes, are leaving an abusive relationship and/or are worried about their safety).

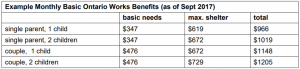

OW benefit amounts vary based on household size and other needs.

You may be eligible for OW if:

- You live in Ontario

- You are in financial need (your household doesn’t have enough money for basic living expenses as

defined by OW guidelines.) - You/other adults you live with are willing to try to find, prepare for, and keep a job, unless you have specific reasons why you can’t work temporarily (e.g. illness, caring for a child).

If you have a disability, you may be eligible for the Ontario Disability Support Program (ODSP). You can find more info at http://www.mcss.gov.on.ca/en/mcss/programs/social/odsp/.

How do I apply?

You can start the application process online, by phone or in person. To find the online application or a local OW office visit http://www.mcss.gov.on.ca/en/mcss/programs/social/ow/.

Rights to (Unpaid) Pregnancy and Parental Leave From Work

If your work is covered by the Ontario Employment Standards Act (ESA) you may be entitled to pregnancy leave and/or parental leave:

- Pregnancy leave can be up to 17 weeks (or in some cases longer) of unpaid time off work during/after your pregnancy.

- Parental leave is unpaid time off work when a child is born or first comes into your care. After taking a pregnancy leave you can take up to 61 weeks of leave. If you didn’t take pregnancy leave you can take up to 63 weeks of leave.

- Your employer can’t penalize you for taking pregnancy or parental leave. In most cases, they must give your job back at the end of it.

- You may be eligible for pregnancy and/or parental leave if you’ve been employed for at least 13 weeks before either your expected due date (for pregnancy leave) or the start of your parental leave.

Employment Insurance (EI) Maternity* and Parental Benefits

EI maternity benefits are payments for people who can’t work because they are pregnant or have recently given birth.

EI parental benefits are payments for parents who are caring for newborn or newly adopted children. You may be eligible to receive EI maternity or parental benefits if:

- Your employer deducts premiums from your pay to pay into EI.

- For maternity benefits, you are pregnant/have recently given birth.

- For parental benefits, you are the biological, adoptive, or legally recognized parent of a newborn or newly adopted child.

- Your normal weekly earnings are reduced by more than 40%.

- You’ve worked at least 600 insurable hours during the qualifying period (usually the 52 weeks before your benefit starts).

The standard rate for EI benefits is 55% of your average weekly pay up to a maximum $573 per week (as of Feb 24, 2020) for up to 35 weeks (or 39 divided between 2 parents). The extended rate is 33% of you average weekly pay up to a mamximum $344 for up to 61 weeks (or 69 between 2 parents). If your household makes $25,921 or less yearly and gets the Canada Child Benefit, a Family Supplement can increase the rate to up to 80% of your average pay.

* We use the term “maternity” here for ease of finding the EI benefit but we recognize that not everyone who is pregnant is a mother or identifies with maternity.

How do I apply?

You may be able to apply for EI benefits as soon as you stop working. The application is online at http://bit.ly/EIapply.

Child Care Subsidies

You may qualify for a government child care subsidy if your child:

- is under 12 years old (up to 18 years old if they have a disability)

- is in a licensed child care program, is a school-aged child enrolled in a recreation program, or is in a before- and after-school program in a school that offers full-day kindergarten.

The amount you pay for child care after the subsidy is applied depends on your family’s income. Child care subsidies are administrated through local agencies so check with the agency that does the administration for your area for rates, application process, and other info. If you live in Toronto you can find more info and a rate calculator here: http://bit.ly/TORchildcare.

More Support/Information

If you need more in-depth support or assistance with things like employment, housing, or finding out what financial supports are available to you, or if you want help starting applications, PPT’s Case Coordinator may be able to help connect you with helpful resources.

If you are under 19 years old or younger and are pregnant or have a child, Jessie’s Centre (http://jessiescentre.org/, 416.365.1888) can provide assistance with things like employment, housing, or finding out what financial supports are available to you, as well as some food and clothing supports and other resources.

(source:

(source: